A few years ago while visiting the city of Jos, which is located in north-east Nigeria, a person pointed to a vast neatly kept area behind a fence. “This ranch belongs to the Queen of England,” he remarked. Everyone was stunned because there is always an impression that independence in the 1960s resulted in a divorce between Britain and its former colony. That piece of evidence intrigued more questions than it provided answers. Did Africa really gain political independence from European powers? What were the terms for this independence that were agreed between colonialists and ‘liberators’?

Slowly but surely it is quickly emerging that land, minerals and other natural endorsements were not transferred to the new countries. After all, one of the chief reasons Europeans annexed territories overseas was for them to contribute directly to the economic well-being of countries such as England, France, Spain, Portugal, etc. It is therefore unlikely that these countries would have just packed their bags and left considering the importance of colonial territories to their economies.

Decolonization was never always well received by former colonial powers. Instead of transferring political authority to the new rulers, they withheld critical powers that would have ensured genuine independence without any strings. As such, an argument can be made that the only type of decoloniality that could be tolerated was the one that could happen within certain parameters. Stories on African independence always focus on the French control over West Africa and on how the Portuguese destroyed Mozambique’s infrastructure in 1975 by dumping cement down the plumbing and sewer systems before handing the country over after independence.

What is little spoken about in history and political literature is how Britain also ruined its former colonies. Thus, this article will showcase how London didn’t let go of the political and economic power it had over its colonies. Australia, Canada and New Zealand, among others, have stayed as part of the British Crown. So, the discussion will not include them. However, the focus will be on the territories that gained total ‘political independence’, particularly in Africa.

The main argument is therefore that it is inaccurate to study colonialism as a historical phenomenon but it is a continuous affair that still defines the character of its former colonies. The presence of former colonial powers in the daily economic life of the so-called independent countries is something that continues to elude researchers, commentators and political activists alike.

Britain granted Egypt partial independence in 1922 but retained control over the Suez Canal. When Gamal Nasser forcefully took over the waterway in 1956, Britain reacted angrily by declaring war on Cairo. Britain along with France then invaded Egypt and seized back control of the canal. What this explains is that the much spoken about independence in Africa never really took place. This article will hopefully contribute to the understanding on why Africa has generally fared poorly in the economic and political fronts. The British experience in Egypt shaped the nature of independence that was bestowed on the new countries. Britain moved from being a colonizer to uncontested owner of all resources and mass looter.

The mixed economic fortunes of most African states can be ascribed to brutal British financial power, and financial interests of the little known political entity in Westminster called the City of London. This effectively makes London the de facto capital of financial deregulation in the world; New York or Zurich don’t even come close. London therefore owes its eminent status as the world’s foremost financial centre to its own tax heaven of sorts within the jurisdiction of the large city. That explains why Britain has the large concentration of international banks than any other financial centre, the African and South Africa’s wealth is predominantly stored or directed from this shady place.

France Sets the Tone On Decolonization

Although the Spaniards, Dutch and others were first to have colonies abroad, it was the English and French that suffered losses when their former colonies declared independence. Thirteen colonies in North America declared war on Britain which took place between 1775 and 1783, when the belligerent parties signed the Treaty of Paris which led to the formation of the United States as a sovereign state. France, Netherlands and Spain fought on the side of US against Britain. They never imagined that their territories would also follow the same path a few decades later.

Paris has always been more direct in their approach when dealing with political independence of their colonies. Starting with the slave revolt on the island of Hispaniola in the Caribbean which led to the independence of Haiti in 1804. France set the tone in terms of how political aspirations of people in ex-colonies would be dealt with. Writing for Forbes magazine, Dan Sperling explains that in 1825 the island nation was “forced to begin paying enormous ‘reparations’ to the French slaveholders it had overthrown”. Sperling says Haiti had to pay France about USD21bn to save its independence from threats from all slave-owning countries (particularly the United States) as well as its very existence from “rankled racist sensibilities globally.”

The Haitian independence delivered a huge blow to Spain as well, but the situation wouldn’t have been dire without Napoleonic wars in the Iberian Peninsula. Britannica states that Napoleon’s imprisonment of King Charles IV and his son Ferdinand in 1808 implied that “the hub of all political authority was missing” in Spain. The publication adds that this occurrence meant that the French ruler had sparked a deadly political crisis that swept across both Spain and its possessions. Spanish colonies stretched from what is now southern and western US states, e.g. Texas, Arizona and California, to Chile. The weakened Spanish empire meant the carcass was there for the taking. Between 1808 and 1826, numerous wars of independence were fought in Latin America.

Liberation hero Simón Bolívar, solicited the Haitian military for financial support to free Venezuela, Bolivia, Colombia, Ecuador, Peru and Panama from Spain. Spanish Mexico resulted in modern states of Mexico, Guatemala, El Salvador, Honduras, Nicaragua and Costa Rica. Overall, the independence of these states did not necessarily end the Spanish presence in its former colonies but it merely took a new shape. Wars of independence were fought by Spaniards born in the New World (criollos) against those born in Spain (peninsulares). As a result, the economic and social structures of post-colonial states did not change much which necessitated, among others, a revolution in Mexico between 1910 and 1920.

Almost one hundred and sixty years after Haiti broke free, France was in line to lose even more foreign territories, but now in Africa. The new states in West Africa were arguably going to get an even bigger punishment than Haiti, their economies were to be tied to that of France. Obviously, Paris held the wealth of ex-colonies and also made decisions that were consistent with its political and economic control. Felix Tih and James Tasamba state that the new states were required “to vest their foreign exchange reserves with the French central bank”. Nigerian journalist David Hundeyin suggests that this ‘neocolonial tax’ which was mischievously concluded in 1958 contributes a sizable portion of the USD2.5 trillion strong French economy.

Britain’s Transformation from Colonizer to Landowner & Mass looter

Together with Britain and Portugal, France lost the most valuable possessions in Africa. Spain only had Equatorial Guinea, Saharwi, and smaller territories in Moroca (Ceuta and Melilla) as well as the Canary Islands. Nevertheless, the European powers were not going to surrender control cheaply. Their former treasures are still bound to colonial heritage through structures such as the Commonwealth of Nations, Community of Portuguese Language Countries, and International Organisation of La Francophonie. But as previously indicated the story doesn’t end there: Britain is still the largest landowner in independent Africa. In countries like South Africa and Kenya, the British messed up the system of landownership through finance.

For most people this link between land ownership and finance would not be obvious. So, it is necessary to again visit history to understand this phenomenon. As previously stated, Britain gave Egypt partial independence in the 1920s and it is in Egypt where the invincibility of shady world finance in the world began. Business schools and classes in economics, law, accounting or politics don’t teach this most important piece of history and its relevance to the controversial topics of illicit financial flows, and global corruption. Normally, such things as tax avoidance, organised crimes, transfer pricing, etc. are treated as an anomaly whereas they are an integral part of continued colonialism all over the world.

The loss of colonies enhanced or reconfirmed Britain’s status as a criminal state, a fact that was known even during the Opium Wars with China in the mid-nineteenth century. It is true that Britain has tried everything starting with slave trade, drugs, which made it gain the infamous tag of the world’s first narco-state, colonialism and finance. World history is much more interlinked than it is often acknowledged. And the growth of capitalism bears testimony to this observation. Hence, it is quite difficult to dissociate capitalism and banks from brutality and criminality.

In 1876, nonetheless, British courts “began to distinguish (for tax purposes) between a company’s place of registration and the place from where it is controlled”. This ruling was re- affirmed in 1929 when the court declared that a company called the Egyptian Delta Land and Investment Co. Ltd., which was registered in the UK but which had moved its board of directors to Egypt, “would not be taxed in the UK”. That case essentially explains how the so-called tax havens and money laundering practice found expression in the international system. Not only that, it also pre-empted how Britain would treat its colonies in Africa, Asia and elsewhere after independence.

Memories of the humiliation in the Suez Canal debacle meant that Britain, especially its financial sector, grew extremely alert in terms of protecting domestic wealth and influence. Tax Justice Network reasons that this position resulted in two biggest things that continue to shape the world of finance today. Firstly, there was an emergence of the offshore ‘Euromarkets’ in London, a new deregulated market that grew explosively and forced through global financial deregulation. Secondly, a post-imperial network of British ‘satellite’ tax havens developed around the globe.

As confirmed by Michael Oswald’s documentary film titled Spider’s Web: Britain’s Second Empire (2017), in the 1960s Britain transformed itself from a colonial power to a financial power. Essentially meaning the same, this transformation entails Britain’s parasitic life and ransacking of wealth in former colonies through a number of strategies including tax havens located at its many offshore jurisdictions to funding political instability and corruption

Britain is in charge of global financial centres including three Crown Dependencies (Jersey, Guernsey and the Isle of Man) and the 14 Overseas Territories, which include such offshore giants as Cayman, the British Virgin Islands and Bermuda.

Although regarded as independent ex-British territories, places such as Belize, Hong Kong, Mauritius and Singapore are part of this extensive network. Of course, tax havens today exist beyond the UK. Tax Justice Network regards the UK as “one of the biggest, if not the biggest, single player in the global offshore system of tax havens (or secrecy jurisdictions) today”. But when one examines the Financial Secrecy Index, Britain would generally feature in moderate positions. The reason for this is that it externalised its active looting to its network offshore financial jurisdictions. If anyone thinks colonialism ended in the 1960s, he or she should think again.

The UK therefore ranks in the top bracket for financial secrecy, together with Switzerland, Luxemburg, Belgium and the Netherlands. Is it a coincidence that the major corporations that left South Africa in the past two decades such as SAB, Anglo-American and Naspers went to these countries? But what about the role of individuals in the post-apartheid South African state who used their positions to facilitate the country’s financial drain through flexible exchange controls and similar interventions? What about stern resistance to nationalization of South Africa Reserve Bank (SARB), economic transformation and expropriation of land without compensation? All these questions hopefully shed some light on many mysteries that exist in South Africa today.

Death at Independence – A “Free” Africa Was Born into Criminality

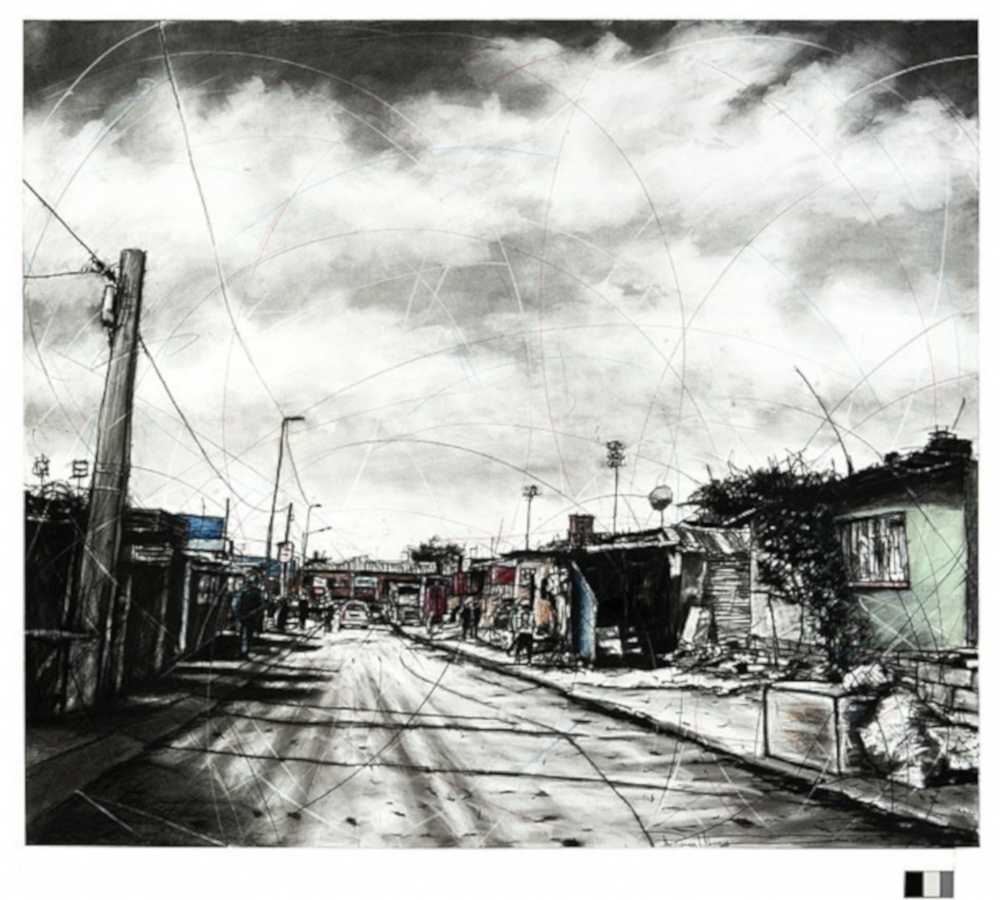

When African countries gained independence in the 1960s, they walked into a very hot fireplace and this occurrence is grossly overlooked by many historians, developmental economists and political scientists alike. Focus is placed so much on the Cold War and its vagaries but economics is treated as a by-the-way, except mention of the structural adjustment programmes (SAPs) as if everything was hunky-dory. Admittedly, the post- colonial state has not done itself with many challenges it has created but truth needs to be told that political independence in Africa was meaningless without the control of the economy and its levers. London continued to be an economic capital for Botswana, Ghana, Sudan, Uganda, Kenya, Tanzania and Nigeria, financially speaking at least.

But the Marxian base-superstructure maxim maintains that economy drives politics; thus the affairs of the new states were decided by the barons in London. The Cold War could be seen as an economic phenomenon rather than a political one since London and its Western allies feared that they would lose their fortune located in these countries to the Soviet Union.

Indeed, Richard N. Haass is correct to point out that the Cold War was “won as a result of decades of sustained US and Western pressure on the Soviet Union and its allies”. In the long run, the lessons from the Cold War have led to yet another disturbing phenomenon of the ‘finance curse’, not just in the UK but in overseas countries, including South Africa, when the British own massive assets in land and mining.

Britain The Undisputed Landowner in Africa

Over financialization of the South African economy, among others, acts as a hedge strategy from Britain and like-minded countries and companies against ‘political uncertainty’, as seen in 2015 when former president Jacob Zuma removed Nhlanhla Nene as finance minister. The JSE reportedly lost R170 billion and the currency devalued as a result of that decision. What this implies is that the United Kingdom uses economics to weaken countries via outright stealing using tax havens, currencies and finance portfolios.

The collapse of the Zimbabwean economy is a hallmark of this strategy, and others like South Africa who wish to implement land reform, are quickly reminded of what is likely to befall them should they proceed. It is therefore not surprising that former British Diplomat, Lord Robin Renwick moved from his seat to join the fight against those who were seen to be threatening UK interests in South Africa. The idea of state capture, therefore, is a display of Britain’s uncompromising political madness to protect its prized possessions in South Africa.

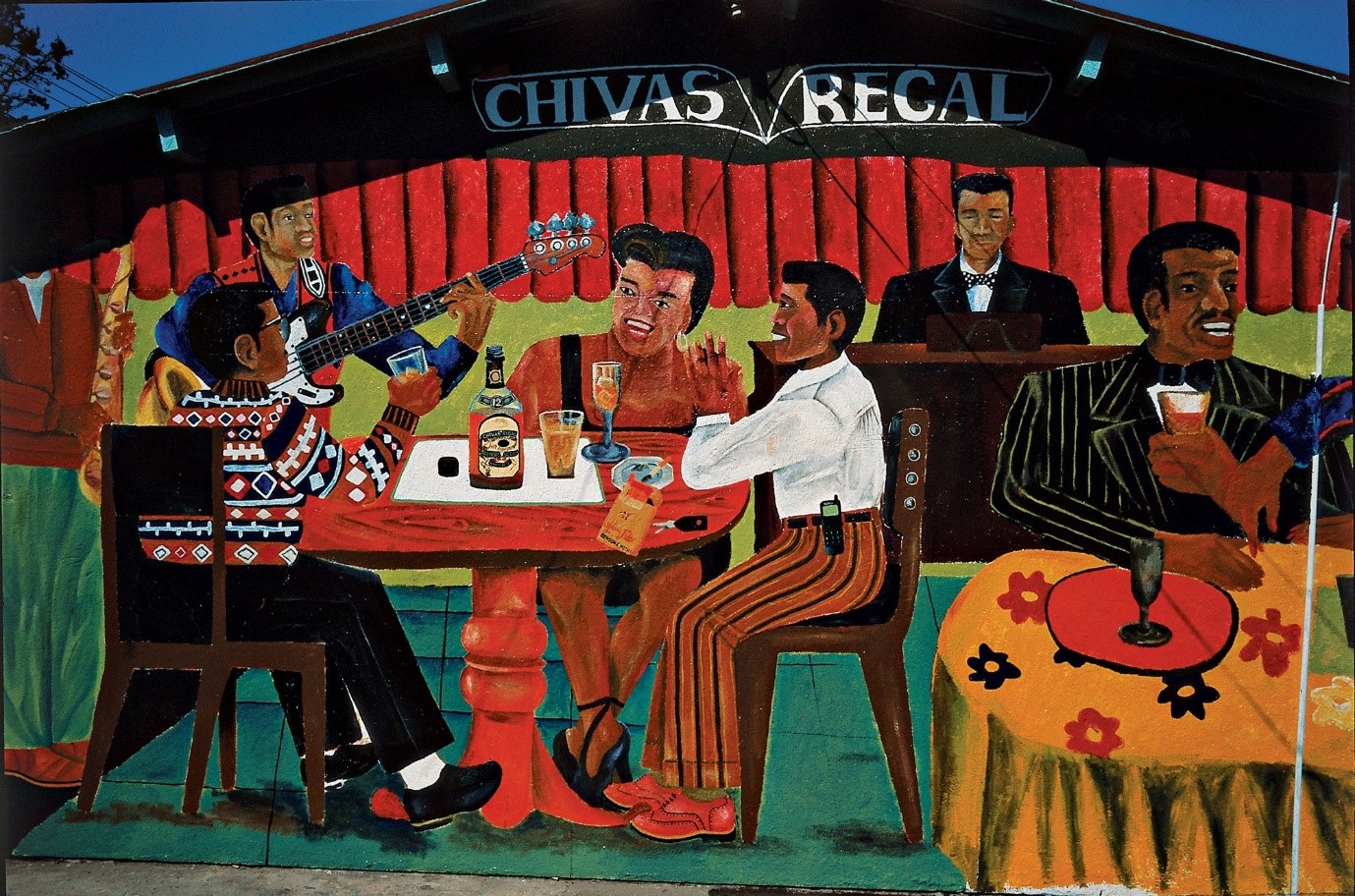

In any case, people only know about the Ingonyama Trust in KwaZulu-Natal, but there are the Queen’s land parcels all over South Africa held in trusts on behalf of the Crown. British economist John Christensen estimates that these trusts all over the world are worth as much as USD50 trillion. This form of ownership (trusts, a form of secrecy) is also actively used to conceal identities of the true owners of land in South Africa. For example, the 2017 Land Audit revealed that sizable amounts of land are held by companies or maybe shell companies (25%) and trusts (31%). It is clear why land reform will never take place in South Africa.

Also, there is a belief that the exit of Anglo-American from South Africa to establish its headquarters in London after the fall of apartheid would usher a new era in mining. However, the truth is that neither land nor minerals have evolved to be in sync with political freedom in South Africa. What is least spoken about is that land, mining and the economy demonstrate the attainment of the British strategy explained above. Financialization characterises not just the economy but land and mining too. There is a belief that South Africa’s economic woes can be solved using mainstream economic tools: this is the greatest fallacy. The strength of the financial sector and dependence on commodities is by design and does not help anyone. The structure of the economy is an expression of the British imperial control.

Parting Shot - British Global Financialization Strategy is Real

As the last territory, besides the Afrikaner independence in 1961, to finally leave the British empire, South Africa is feeling the brunt of the British global financialization strategy. If France retained control over foreign reserves in ex-colonies after independence, United Kingdom retained land ownership and mines. South Africa is truly under the British sphere of influence and so are its fellow African states, including Angola and Mozambique. The UK prime minister Boris Johnson has said the Commonwealth “is a real asset for the UK”. After Brexit, Britain is freer to move with speed in reconsolidating its power base.

The multi-state visit in 2018 by Johnson’s predecessor Theresa May indicated that Britain’s attention was once again on Africa. The choice of Nigeria, Kenya and South Africa was not random but an indication where British wealth is stored. The UK vision for Africa is well articulated in the article ‘Africa is a mess, but we can’t blame colonialism’ in the Spectator magazine (2002), wherein Johnson said: “The continent may be a blot, but it is not a blot upon our conscience. The problem is not that we were once in charge, but that we are not in charge anymore”.

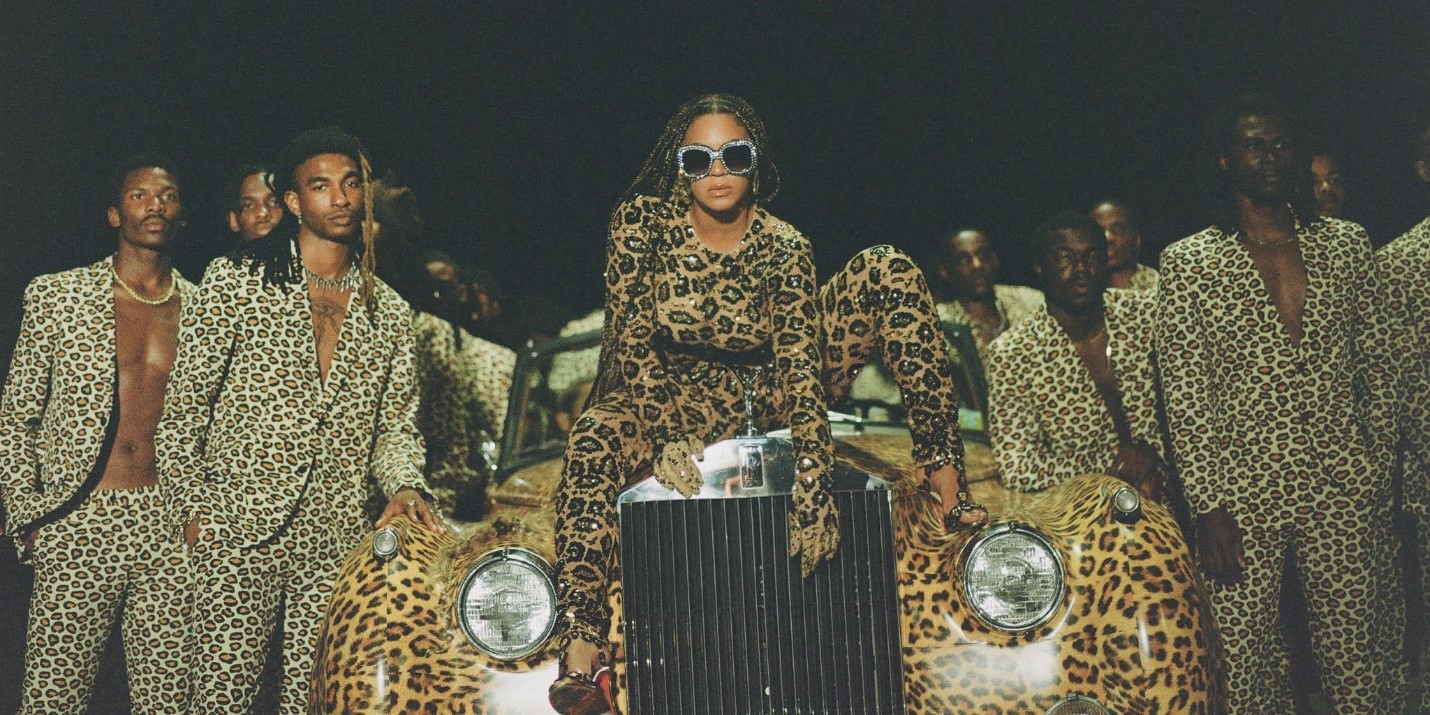

Britain could be behind the move to gentrify the identity of Black people in South Africa to ready the continent for Cecil John Rhodes’ Cape to Cairo dream of connecting British colonial interests on the continent between southern Cape and Egypt. In this, finance, not guns, will play a huge part when Britain returns to fly the Union Jack over Africa one more time.

God Save The Queen!